In-Depth Guides

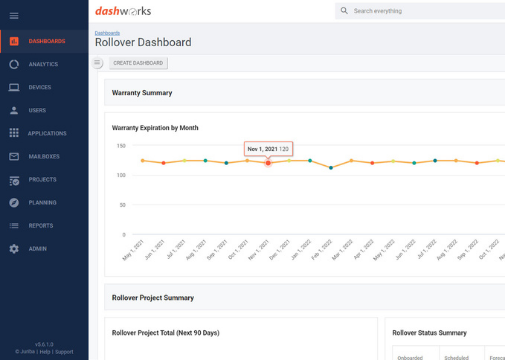

Making Continuous IT Transformation To Tens of Thousands of End Users Easy.

Keep your entire IT environment up-to-date, secure, and performing well by managing your OS upgrades, email migrations, hardware refreshes, and any other IT transformation with Juriba Workplace Automation.

of the Top 50 Banks worldwide manage their IT using Juriba Workplace Automation.

Return-on-Investment when managing multiple Evergreen IT projects with Juriba Dashworks.

Project savings with Juriba compared to managing Evergreen IT processes in a traditional way.

How Juriba Can Help

Juriba's Workplace Automation platform enables banks and financial institutions around the world to manage their IT by providing a single pane of glass and end-to-end automation through intelligent workflows.

-

done

Create tailored migration paths for different types of workers for a speedy but smooth migration process

-

done

Manage multiple upgrade streams in the background without constantly disrupting your end users

-

done

Improve your employee technology experience and boost productivity by unlocking the full potential of your Modern Workplace investments

-

done

Avoid security breaches, system failures, data loss, and software audits by minimizing security vulnerabilities

-

done

Streamline the discovery, rationalization, packaging, testing, and managing of all the internally-built custom applications that usually are a nightmare to migrate, especially if they are unlikely to work across different system versions.

Why It Matters

Banks and financial institutions face extremely high stakes when it comes to managing

their Workplace Automation successfully — maybe higher than for any other industry.

Security Is The Key Priority

73% of senior bank managers are hesitant to adopt new technology, such as cloud computing because of security concerns (Forester). However, outdated software and unauthorized apps are posing huge risks and security should be the primary driver for IT Transformation!

Fear of Failure & Risk-Aversity

Financial services are very competitive and commoditized, resulting in a lot of pressure on the IT team to never fail. This drives project managers to be risk-averse and very careful in pre-project planning — resulting in a constant battle in which agility and speed compete against control and risk mitigation.

Great Customer Experience

Since banking and finance are such competitive service industries with no physical products to sell, customer service is the #1 priority. If you cannot deliver a consistently great customer experience across all channels and devices, you are at risk of losing that customer to the competition.

Just some of our

happy customers

We work with some of the largest financial institutions and banks in the world — many of them managing multiple Evergreen IT project streams in parallel on a continuous basis.

.png)

How Can Juriba Help Your Organization?

Schedule a personalized demo of our powerful Workplace Automation platform today and find out

how Juriba can help your team increase security, boost productivity, and become more agile!